Continuing our blog series looking at specific IPT-related tax acts around the world, we head to Denmark.

This insight is shared in Sovos’ Guide on IPT Compliance. Written by our team of IPT and regulatory specialists, this guide is packed full of insight to navigate the ever-changing regulatory landscape.

Insurance policies with a risk located in Denmark are subject to Danish insurance tax, if taxable under the Danish Non-Life Insurance Tax Act (Skadeforsikringsafgiftsloven).

Registration applications must be submitted to the Danish Central Business Register before Danish and foreign insurers can legally settle tax in Denmark.

Foreign insurers located within EU Member States or other permitted countries can choose to register in Denmark with a representative (individual or business) residing in Denmark.

Once registration criteria has been met, a tax identification number equivalent to a VAT Number (CVR number) is issued.

This number is used for an online portal administered by the Danish tax authority (SKAT), where various tax returns can be submitted.

The tax model and rate in Denmark for most non-life insurance classes is the taxable premium and 1.1% respectively.

Exemptions and exceptions to this treatment include:

Whilst the majority of commonly reported non-life taxes are mentioned above, additional taxes may be applicable to policies located in Denmark and therefore cannot be disregarded.

For example, an Environmental Contribution is applicable to third party liability insurance of large transport vehicles, while the Danish Terrorism Scheme contribution is due annually on policies which cover specific fire risks, implemented to compensate damages caused by terrorist acts.

Insurance policies may be subject to none or all of the above taxes in Denmark, depending on the type of coverage. It’s therefore essential that both the insurer and its representative understand when each tax is applicable.

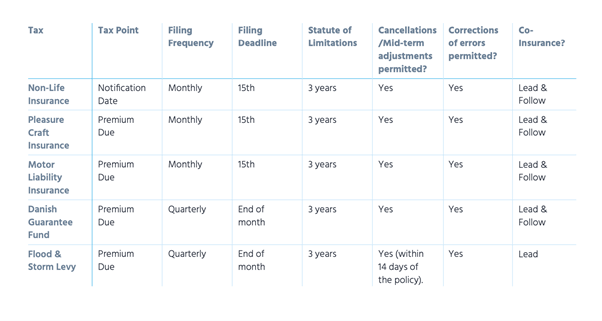

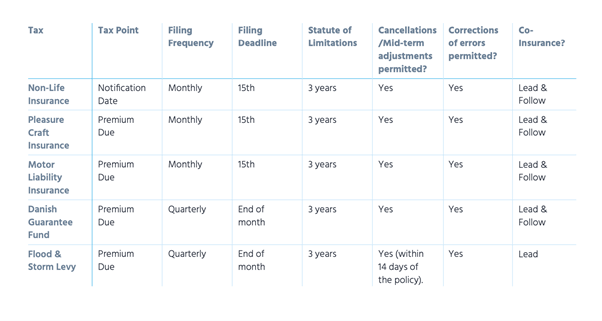

Key information for non-life insurance tax and all of the exceptions is outlined below:

Key information for non-life insurance tax and all of the exceptions is

Sovos helps ease the burden of IPT compliance through a blend of regulatory knowledge and expertise, and best-in-class software built to handle compliance obligations now, and in the future.

Download our IPT compliance guide for help with navigating the changing regulatory landscape and deadlines successfully, across the globe.